The past 2 years marked a significant shift in companies investing more into their customer experience programs. Whilst many measure separate KPIs such as NPS and customer satisfaction, a successful CX program requires continuous feedback collection and a deeper, more granular customer data analysis. Getting to know your customers has never been as crucial, as it is today.

Why do you need a holistic customer experience program?

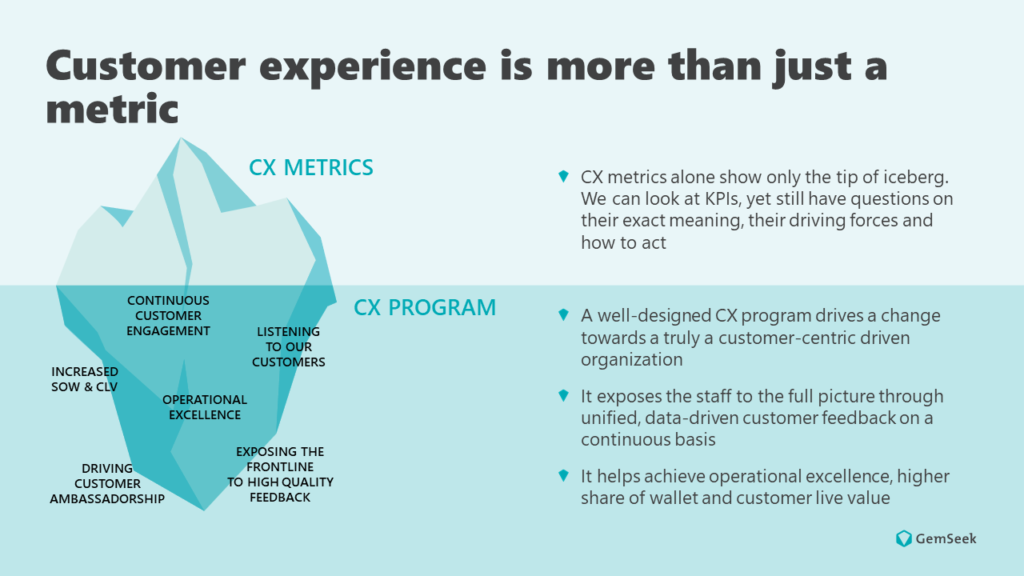

The iceberg analogy aptly applies to customer experience, where surface-level observations only reveal a small part of the whole picture. Standalone metrics may not be sufficient to drive substantial change or transformation unless integrated with underlying elements. In the realm of CX, these hidden components include continuous customer engagement, operational efficiency, and heightened loyalty and advocacy, which are all vital for achieving customer success.

Start with understanding customers better. New customers are the source of new business. When taking strategic decisions about business growth, you need to gather feedback not only from your existing customers but the customers of your competitors, too. Not taken into consideration, you enter a gambling game, hoping for the best.

Why do you need to understand how customers experience your competitors?

Customers can be happy and satisfied with your performance, and some of them can even become passionate promoters, recommending your business to their peers. But if they like your competitors more, or at least just as much, you will be losing sales.

Competitive measurement can help you track performance and find the best ways to approach your competitors’ audience.

Competitive benchmarking gives you a snapshot of where you are, and a map of where you could potentially go should you understand customer behaviour, prioritise and plan according to your goals. Through this type of measurement, you will better understand why some customers are likely to choose you, and others will go straight to your competition. These analyses study the competition’s portfolios of services and products, business strategies and best practices. A competitive benchmark will help you:

- Enhance brand preference

- Drive strategic improvements

- Retain and win more customers

In CX language–promoters, or happy customers, drive growth. Fundamentally, they are happier to spend more and stay longer.

To be effective in your delivery, you need to understand your audience–their preferences, drivers of behaviour and usage patterns, compared to the competition. Such insights will give you a strategic direction and will empower you to shift focus to the areas that need urgent care and attention to prevent losing customers and focus efforts on gaining new ones.

For instance, consider doing a survey where you ask:

- How do your customers feel about doing business with you (ease of doing business)?

- How would they rate the quality of your products?

- How do they feel about the payment terms you provide (flexible payment terms)?

You might discover you’re performing exceptionally well but turns out your competition is overperforming in that same category, resulting in you bleeding customers. When executed, this comparison can give you both a competitive advantage when bridging the gap to the best competitor, and jumpstart your operational excellence initiatives, so you can outgrow your current state of doing business.

Interested how to add some competitors’ context to your customer satisfaction scores?

Have a look at our Competitive CX Benchmarking services.

Integrating bottom-up and top-down CX metrics towards a holistic customer experience program

How does your customer experience program operate–top down or bottom up? Both approaches have their pros and cons, but executing each one separately can stagnate the CX program just as much as improving it.

The top-down approach will ensure you have the C-level executive endorsement, which on its own allows for proper prioritisation of the CX strategy across your entire organisation, as well as secures the needed investment to keep the program running.

Bottom-up takes longer but drives more stable and sustainable results. To execute this approach, you first need to have enough internal engagement from multiple teams and stakeholders who proactively display a true passion for customer experience and promote the products and services you offer both internally and externally. Bottom-up leaders accomplish CX success by continuous engagement with their teams and proactively identifying and pursuing issues and improvements that need addressing both within their own accountability and through collaboration with other departments.

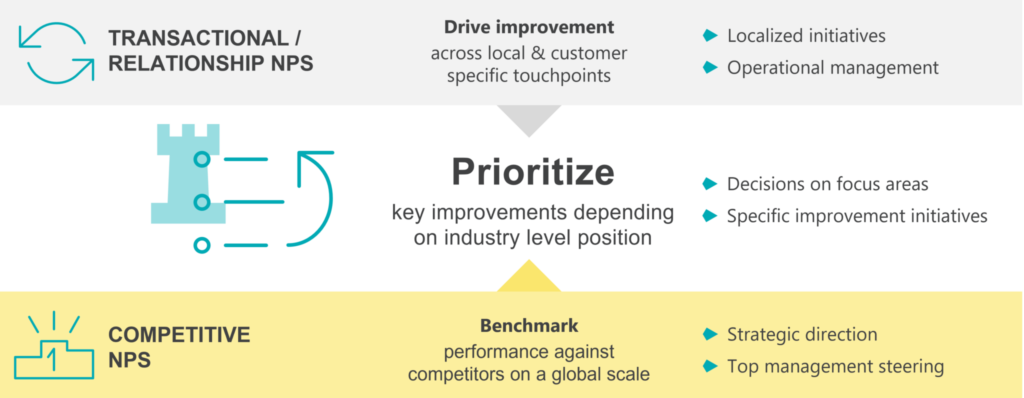

A holistic program combines both, whilst manifesting the results through the actions prescribed by Relationship NPS and Competitive NPS. rNPS will help you drive improvement across local and very specific customer touchpoints, focusing on localised initiatives and operational management, whilst cNPS will give you a larger overview of where you stand, and how you perform against competitors and compare the results with other leaders within your community. This will drive a strategic direction, whilst keeping the C-level executives interested and engaged.

EXAMPLE

RELATIONSHIP NPS

(rNPS): 53

The annual relationship NPS shows that despite the negative experience with the delivery, customers are still somewhat happy with the company overall. The general availability of sales reps can be improved.

TRANSACTIONAL NPS

(tNPS): -15

A delay in the delivery date in some regions causes dissatisfaction with customers. This is captured by the post-installation transactional NPS survey, which is launched every time after an installation is complete.

COMPETITIVE NPS

(cNPS): 35, follower

The bi-annual competitive NPS is positive but shows that the company is not the market leader. The depth of the survey allows deep-dives into touchpoints and pinpoints that pre-sales and education services are the biggest drivers of the low score. These two drivers also influence the decision to switch vendors.

rNPS:

Promoters can be leveraged into referral campaigns to improve the brand image.

tNPS & rNPS:

The company needs to close the loop with the dissatisfied customers, show their voice is heard and offer a solution or remedy to improve their experience.

cNPS:

The company needs to pay attention to its competitive weaknesses and improve the experience customers have during pre-sales and education in order to avoid losing customers.

Tactics: How to introduce a CX benchmark against competitors

So, how do you equip yourself with the proper tools to compare strategy, performance and delivery against your competitors?

Competitive Benchmark is holistic regardless of what metric you measure within your organisation

Double-blinded surveys are the best way to measure competitive benchmark metrics, such as Competitive NPS (cNPS). This way respondents are more honest and willing to share issues they won’t otherwise. Typically, respondents are recruited through panels and incentivised additionally with fair market value incentives, meaning they are willing to spend more time with you, testing multiple touchpoints to help you get deeper insights.

Non-competitive NPS has a certain bias. Customers know who they are talking to, which may lead to brushing off some potentially serious issues. For example, they may not want to put their sales rep at risk because they have a good relationship with them. But if tomorrow that sales rep goes, the issues will persist.

Leaders use Competitive CX Benchmark to drive strategic initiatives and improvements

Join companies such as Philips, Rockfon and Liberty Global that prioritise the improvements and initiatives that will make a true difference.