Vulnerable customers* can be up to 50% of your whole base and up to 30% less satisfied than the average customer. Regulations and the overall public expectation for fair and equal treatment are on the rise. Our Vulnerable Customer Experience Solution captures vulnerability signals in your existing text data, like survey responses or complaints, and gives you a clear picture of how many of your customers may be susceptible to harm and why. It helps you drive focused improvements on the organisational level and improve the individual treatment of customers-at-risk.

*As defined by UK Financial Conduct Authority, vulnerable customers are defined as such due to their personal circumstances like health challenges, poor emotional resilience or decreased capabilities.

Understand the specific needs of vulnerable customers across their entire journey and adjust your processes and procedures for increased inclusivity.

Understand why vulnerable customers are less satisfied and target the real reasons why their satisfaction score never goes up.

Ensure compliance with existing regulations for your industry and reduce the risk of legal actions and fines.

Demonstrate in a transparent way your ethical responsibility towards customers and protect your brand from undesired publicity.

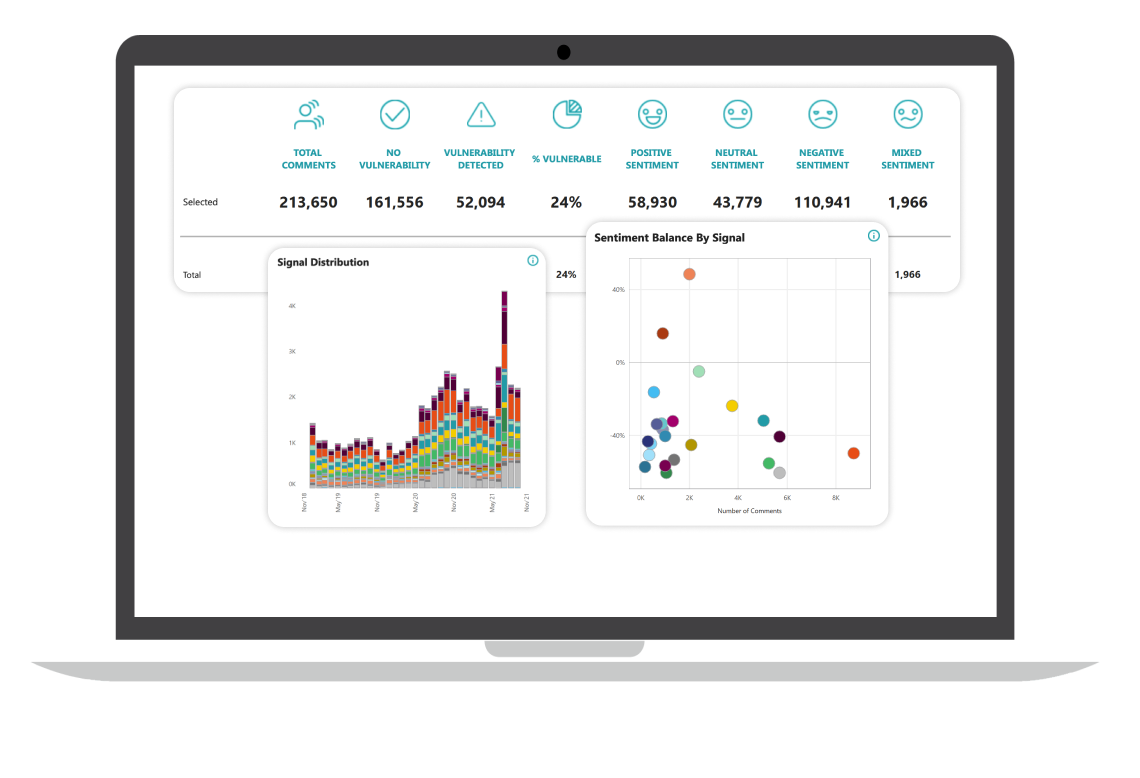

Identify how many of your customers belong to the main vulnerability categories, such as “Health”, “Digital Capability”, “Resilience” and others relevant to your business context.

Understand what signals speak for each type of vulnerability, what customer experience issues are triggered as a result and the potential harms to customers.

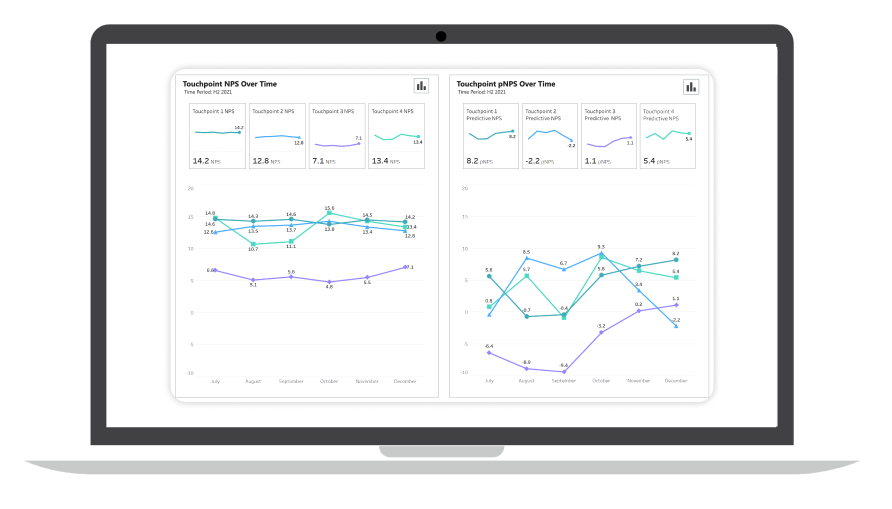

Evaluate the impact of vulnerabilities on key metrics, such as NPS, customer satisfaction, average customer lifetime value and more.

Link vulnerability detection to your existing customer service systems, allowing frontline employees to get signals in real time and protect customers from harm.

Many factors add up to an individual becoming susceptible to poor decisions and payment problems, especially in cases when met with aggressive promotions and sales techniques.

See why it’s important to deploy vulnerable customer experience management within your existing CX program and protect that segment of your customer base.

The Vulnerable Customer Experience solution is powered by a text analytics engine, which relies on a specific ontology/taxonomy to identify vulnerability signals in the open-ended texts customers write in complaint forms and satisfaction surveys. The tool classifies each piece of text according to vulnerability categories, specific signals for each category and potential harms. As an output, companies get an aggregated strategic level analysis of vulnerabilities and their impact on satisfaction, as well as vulnerability flags on an individual customer level.

A vulnerable customer is an individual who, due to personal circumstances or life events, may face challenges or difficulties in accessing, understanding, or effectively engaging with a product or service. These customers may require additional support or a tailored approach to ensure they have a positive experience and their needs are met.

Vulnerabilities can stem from various factors, such as:

Identifying and addressing the needs of vulnerable customers is crucial for businesses to ensure an inclusive and satisfactory customer experience for all.

By understanding and catering to the unique needs of vulnerable customers, businesses can provide a more inclusive and personalized experience, leading to higher satisfaction levels. Identifying and addressing the needs of vulnerable customers not only improves customer experience and satisfaction but also contributes to long-term business success through increased customer loyalty, compliance with regulations, a positive brand reputation, and corporate social responsibility.

Example types of data that go into the model:

The Vulnerable Customer Experience Model is versatile and can be applied across various industries and business models that interact directly with customers. It is particularly beneficial for industries where addressing the unique needs of vulnerable customers is crucial for providing a positive and inclusive experience. Some examples include:

By adopting the Vulnerable Customer Experience Model, businesses in these industries and others can effectively identify and address the needs of vulnerable customers, leading to a more inclusive and satisfactory experience for all.

Both depend on the amount of data, markets, business units, products or other details you want to delve in. A standard delivery timeframe would be between 4 and 6 weeks. As to pricing, we offer a flexible model with one-time set up fees and quarterly subscription for updates afterwards.

Join our newsletter

By subscribing you agree with our Privacy Policy

© 2024 GemSeek, Part of Accenture Song. All rights reserved.

Terms of Service

Copyright NPS® is a registered trademark, and Net Promoter Score℠ and Net Promoter System℠ are service marks, of Bain & Company, Inc., Satmetrix Systems, Inc. and Fred Reichheld.

Web development by MySuper.Site